san francisco county sales tax rate

In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled. Appointed in 2004 and first elected in 2005 Cisneros has used his experience in the tech and banking industries to enhance and.

Sales Tax Collections City Performance Scorecards

More than 100 but less than or equal to 250000.

. 3 rows The current total local sales tax rate in San Francisco County CA is 8625. The California sales tax rate is currently 6. The San Francisco sales tax rate is 0.

A county-wide sales tax rate of 025. City of Arroyo Grande 775 City of Atascadero 875 City of Grover Beach 875 City of Morro Bay 875 City of Paso Robles 875 City of Pismo Beach 775. Californias base sales tax is 725 highest in the.

Ad Find Out Sales Tax Rates For Free. This is the total of state county and city sales tax rates. SAN FRANCISCO COUNTY 8625.

If entire value or consideration is X then the Tax rate for entire value or consideration is Y. San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco. This is the total of state and county sales tax rates.

The California state sales tax rate is currently. Therefore you will not be responsible for paying it. 2019 Public Auction.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. You can find more tax rates and allowances for San Francisco County and California in. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year.

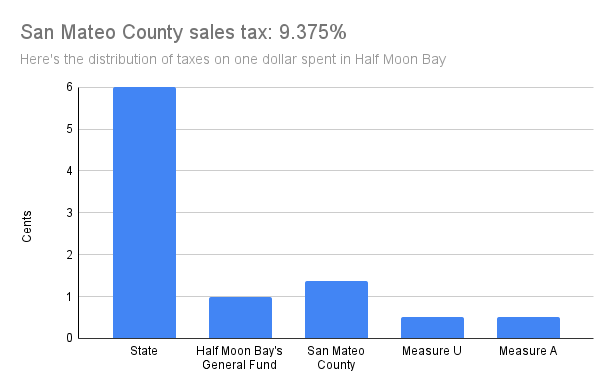

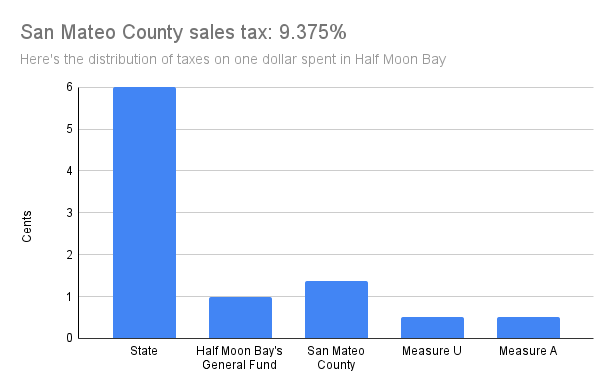

94080 zip code sales tax and use tax rate South san francisco San Mateo County California. 1 State Sales tax is 725. Auction Site bid4assets Timeshare Parcels.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Mayor Breed is the first African-American woman Mayor in San Franciscos history. Presidio San Francisco 8625.

Presidio of Monterey Monterey 9250. A combined city and county sales tax rate of 25 on top of Californias 6 base makes San Francisco one of the more expensive cities to shop in with 1362 out of 1782 cities having a sales tax rate this low or lower. The 2018 United States Supreme Court decision in South Dakota v.

250 for each 500 or portion thereof. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. The California state sales tax rate is currently.

More than 250000 but less than 1000000. SAN LUIS OBISPO COUNTY 725. The San Francisco County sales tax rate is.

The minimum combined sales tax rate for San Francisco California is 85. The Sales tax rates may. As Treasurer he serves as the Citys banker and Chief Investment Officer managing all tax and revenue collection for San Francisco.

250 for each 500 or portion thereof. Tax rate for entire value or consideration is. London Nicole Breed is the 45th mayor of the City and County of San Francisco.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. José Cisneros is the elected Treasurer for the City and County of San Francisco. Fast Easy Tax Solutions.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 6 rows The San Francisco County Sales Tax is 025. Auction Site bid4assets Parcels Other Than Timeshares.

1000000 or more but less than 5000000. More than 100 but less than or equal to 250000. 6 rows The San Francisco County California sales tax is 850 consisting of 600 California state.

The San Bernardino County sales tax rate is. The County sales tax rate is 025. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco.

Estimated Combined Tax Rate 975 Estimated County Tax Rate 025 Estimated City Tax Rate 050 Estimated. SAN JOAQUIN COUNTY 775. 340 for each 500 or portion thereof.

City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825. The minimum combined 2021 sales tax rate for San Bernardino County California is. The South San Francisco California sales tax is 750 the same as the California state sales tax.

Sales Tax and Use Tax Rate of Zip Code 94080 is located in South san francisco City San Mateo County California State. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. Although this is sometimes conflated as a personal income tax rate the city only levies this tax on businesses.

In San Francisco transfer taxes upon change of ownership are typically paid by the Seller though it can be otherwise agreed to in the purchase contract. The average sales tax rate in California is 8551. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1.

Method to calculate San Francisco County sales tax in 2021. Property Tax in San Francisco County.

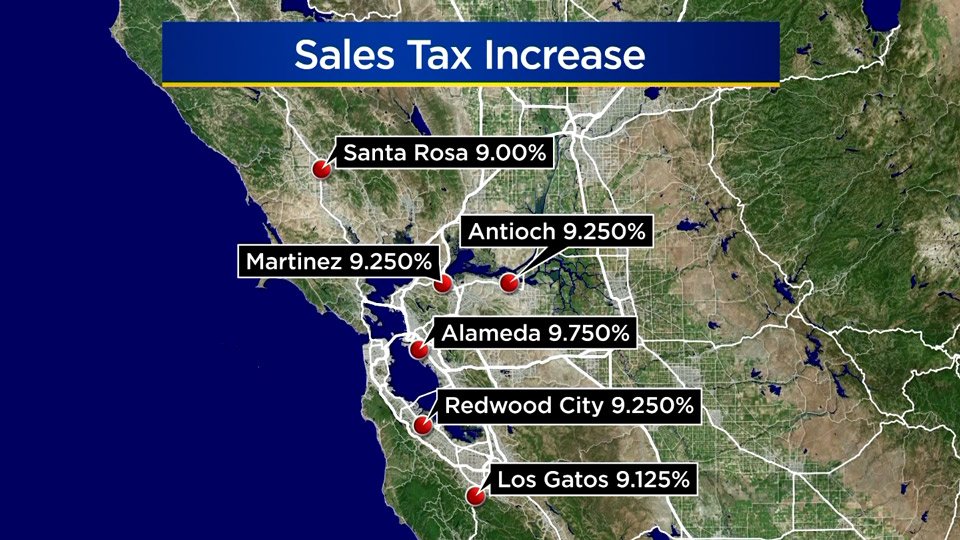

Sales Gas Taxes Increasing In The Bay Area And California

California City County Sales Use Tax Rates

California Sales Tax Small Business Guide Truic

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Understanding Where California S Marijuana Tax Money Goes

Sales Tax Rates Rise Up To 10 75 In Alameda County Highest In California Cbs San Francisco

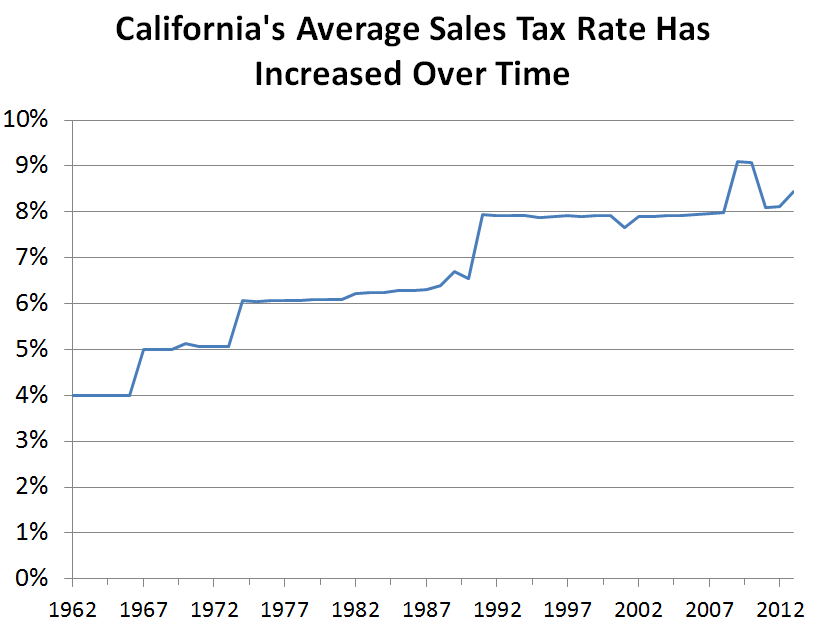

California S Sales Tax Rate Has Grown Over Time Econtax Blog

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sales Tax Rates Rise Monday Out Of State Online Sellers Included Cbs San Francisco